Which of the Following Represents the Most Expansionary Fiscal Policy

B a 10 billion increase in government spending. Its one of the major ways governments respond to contractions in the business cycle and prevent economic recessions.

What Are Expansionary And Contractionary Fiscal Policies And What Situations Are They Used Quora

Memorize flashcards and build a practice test to quiz yourself before your exam.

. Lower government spending Increasing the reserve ratio D. A 10 billion tax increase. A rightward shift in the economys aggregate demand curve.

A 10 billion tax increase. Start studying the Fiscal Policy flashcards containing study terms like When the federal government uses taxation and purchasing actions to stimulate the economy it is The intent of contractionary fiscal policy is to You are given the following information about aggregate demand at the existing. An appropriate fiscal policy for severe demand-pull inflation is D.

Which of the following represents the most expansionary fiscal policy. A tax rate increase. A a 10 billion tax cut c a 10 billion tax increase b a 10 billion increase in government spending d a 10 billion decrease in government spending.

A 10 Billion Tax Increase D. C is aimed at achieving greater price stability. A 10 billion increase in government spending.

A 10 billion increase in government spending. If an increase in 1000 billion aggregate demand can. Which if the following represents the most expansionary fiscal policy.

D a 10 billion decrease in government spending. See the answer See the answer done loading. Involves an expansion of the nations money supply.

An expansionary US fiscal policy might unintentionally cause demand-pull inflation if. A 10 Billion Increase In Government Spending C. Which of the following represents a combination of contractionary fiscal and expansionary monetary policyFISCAL POLICY MONETARY POLICY A.

Is designed to expand real GDP. Is aimed at achieving greater price stability. Lower government spending Increasing the discount rate E.

Up to 256 cash back Which of the following represents the most expansionary fiscal policy. A contractionary fiscal policy is shown as a. Increase in tax rate by 2.

Therefore the most effective fiscal policy will be an increase in the government spending and reduction in. By using subsidies transfer payments including welfare programs and income tax cuts expansionary fiscal policy puts more money into consumers hands to give them more purchasing power. Which of the following represents the most expansionary fiscal policy.

A 10 billion decrease in government spending. Increasing government purchases through increased spending by the federal government on final goods and services and raising federal grants to state and local governments to increase their expenditures on final goods and services. A 10 billion tax increase.

A a 10 billion tax cut B a 10 billion increase in government spending. Increase in government spending of 1 billion. Up to 256 cash back Which of the following represents the most expansionary fiscal policy.

A tax rate increase. A contractionary fiscal policy is shown as a. Which of the following represents the most expansionary fiscal policy.

A decrease in tax rates. A 10 billion tax cut. The dollar unexpectedly depreciates while the expansionary policy is in place.

Fiscal policy is one of the key ways that governments attempt to regulate and influence the economy. Which of the following represents the most contractionary fiscal policy. An increase in the government spending will increase the output whereas a reduction in taxes will increase the disposable income leading to an increase in the output.

A 30 billion decrease in government spending. A 10 billion tax cut. B necessarily expands the size of government.

A 10 billion increase in government spending c. Leftward shift in the economys aggregate demand curve. D is designed to expand real GDP.

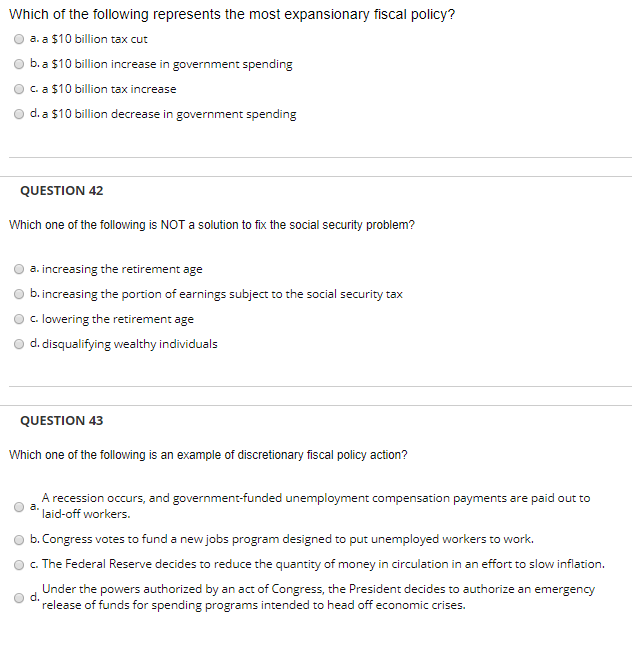

An expansionary fiscal policy refers to the increase in the government spending or a decrease in taxes. Crowding out may occur because ________ fiscal policy usually involves the government ________ money. A 10 Billion Decrease In Government Spending QUESTION 42 Which One Of The Following Is NOT A Solution To Fix The Social.

A 10 billion tax cut. Which of the following represents the most expansionary fiscal policy. Higher taxes Selling Treasury securities B.

A decrease in tax rates. Expansionary fiscal policy is so named because it. Assume that the full-employment level of output is 500 and the price level associated with full-employment output is 100.

Expansionary fiscal policy is so named because it. 30 billion-increase in governm. Lower taxes Buying Treasury securities C.

C a 10 billion tax increase. A 10 billion tax cut. A 10 billion decrease in government spending.

Increasing the retirement. Which of the following represents the most expansionary fiscal policy. It also reduces unemployment by contracting public works or hiring new government workers both of which increase demand and spurs consumer spending which.

Increasing investments by raising after-tax profits through cuts in business taxes. A 10 billion tax increase. And the government follows Keynesian economics by following expansionary fiscal policy to increase aggregate demand total spending.

Increase in government spending of 10 billion. A 10 Billion Tax Cut B. See the answer See the answer done loading.

Rightward shift in the economys aggregate demand curve. A 10 billion increase in government spending. Which of the following represents the most contractionary fiscal policy.

A 10 billion decrease in government spending QUESTION 42 Which one of the following is NOT a solution to fix the social security problem. A 10 billion increase in government spending. A involves an expansion of the nations money supply.

Decrease in money supply by 10 million. 30 billion tax cutb. A 10 billion tax cut b.

Necessarily expands the size of government. A 10 billion tax increase d. Which of the following represents the most expansionary fiscal policy.

An expansionary fiscal policy is shown as a. A 10 billion increase in government spending. An expansionary fiscal policy seeks to spur economic activity by putting more money into the hands of consumers and businesses.

Up to 256 cash back Get the detailed answer. Which Of The Following Represents The Most Expansionary Fiscal Policy. An appropriate fiscal policy for a severe recession is B.

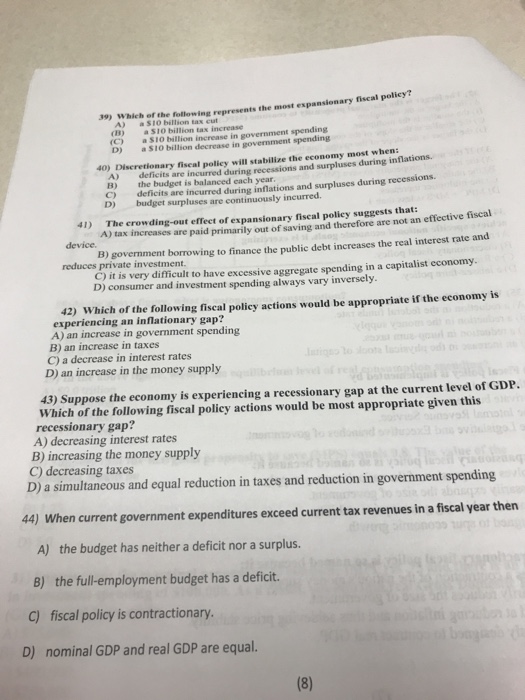

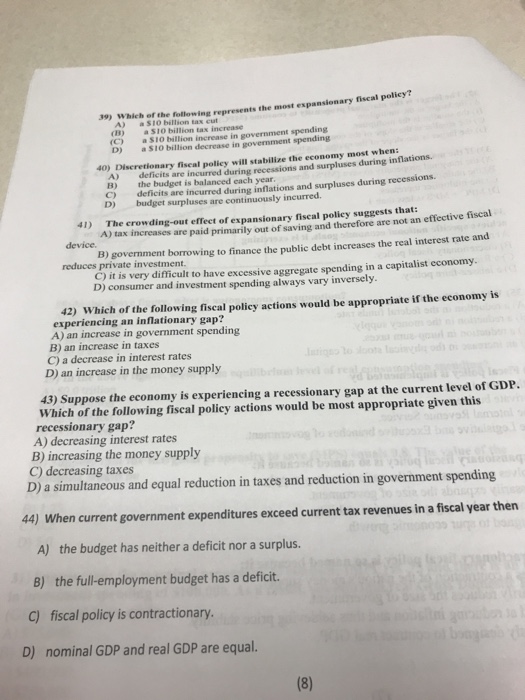

Solved 39 Which Of The Following Represents The Most Chegg Com

Solved Which Of The Following Represents The Most Chegg Com

Using Fiscal Policy To Fight Recession Unemployment And Inflation

Comments

Post a Comment